Cannabis Crypto: An Alternative Business Model for IADs

What do cannabis, crypto, and ATM businesses have in common? They are high-risk industries unsupported by the federal government. All three of these industries are prone to unlawful business practices.

Not fully supported by the federal government, these businesses find it difficult to bank safely and affordably. Often, business owners have to find a work-around, pay ridiculous fees and taxes, and/or face extreme scrutiny and audits.

Could cannabis crypto be an alternative business model for IADs that serves as a solution? Find out how the three industries overlap and can work together.

ATM Businesses as High-Risk Accounts

It’s no secret that many banks are hesitant to take on ATM business accounts. The cash-heavy nature of ATM businesses make them high-risk due to the potential for money laundering activity. Banks have to be especially wary of such liabilities. They are held responsible for servicing companies that conduct unlawful business practices.

In 2021, the Office of the Comptroller of the Currency (OCC) finalized its rule to ensure fair access to banking services by various financial institutions. This means that banks cannot make blanket decisions for whole categories of customers when provisioning certain services. Instead, they must conduct individual risk assessments for each customer.

However, many ATM owners still report difficulty finding ATM business-friendly banks. That’s probably because of the difficulty in making a good impression during the risk assessment….

Not only are ATM business accounts risky for banks to service, they are also expensive. The potential for audits, compliance reviews, investigations, and regulation changes are heightened for banks that do take on ATM business accounts.

They also face federal penalties for servicing a company that engages in money-laundering activity or fraud. Banks that service ATM businesses have to meet their cash needs as well. It can be costly to order the cash necessary and make drop-off arrangements.

These costs might be manageable for larger banks, but they are notoriously less likely to take on ATM business accounts due to the scrutiny they already face. And smaller banks are less likely to take on the extra costs. Therefore, there are few banks that IADs consider ATM-business friendly. And the ones that are can still close accounts at any time with little to no warning.

This uncertainty is a costly threat to ATM business owners. They cannot consistently provide their service if their access to cash is disrupted abruptly.

Cannabis Illegal Under Federal Law

Similar to ATM businesses, legal cannabis businesses also struggle to find access to safe, affordable banking. Although legal in many states, whether medicinal or recreational, cannabis is still illegal under federal law. This means that banks, federal institutions, are bound by certain regulations when it comes to providing services to businesses in the cannabis industry.

Dispensaries cannot accept debit and credit transactions for cannabis-related goods and services. Since cannabis is illegal at the federal level, banks and credit card companies won’t allow these transactions to take place over their networks. And banks have to tread lightly to avoid breaking money laundering laws or servicing businesses that engage in illegal business practices.

That leaves dispensaries no option but to accept cash exclusively. You can imagine the risks this poses to these businesses. Not to mention the costs.

Barred from the traditional banking system, dispensaries are forced to pay excessive fees to bank at state-chartered institutions or hoard cash on-site. And keeping cash on-site is not a cheap alternative. This makes dispensaries targets for robberies and increases the level of internal theft.

Add to that the costs of increased security such as safes, cash-counting equipment, cameras, weapon detectors, and other physical reinforcements. And to combat internal theft, there are the costs of background checks and training.

Nor is cash a hassle-free alternative. Cash transactions in the cannabis industry are especially subject to meticulously scrutinized payment and tax speculation. This causes dispensary owners to fear federal-level accusations of illegal or suspicious business practices.

The stigma surrounding the cannabis industry for the potential of criminal activity hurts dispensaries’ ability to provide legal goods and services to their customers.

Crypto Not Accepted as Legal Tender

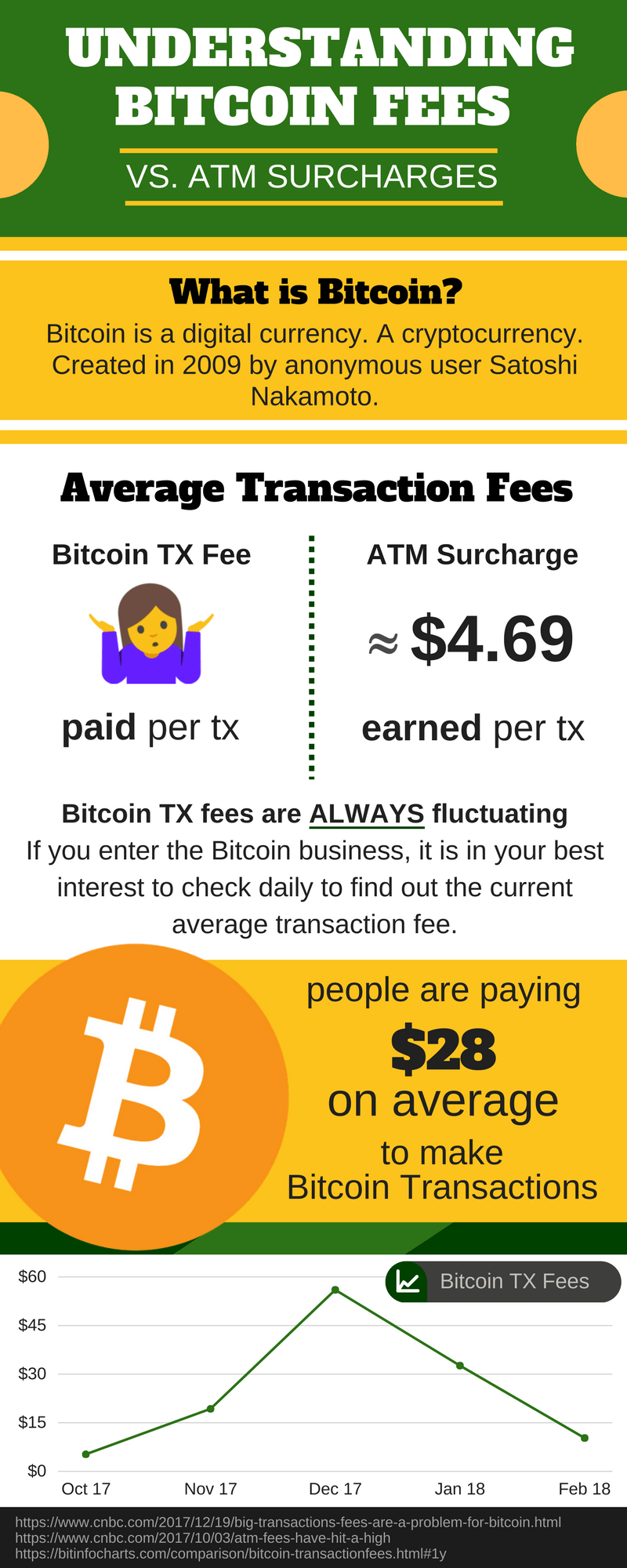

Although a popular payment solution for many reasons, cryptocurrency is not accepted as a legal tender. It is a high-risk investment because of its volatility. Furthermore, since it’s a decentralized currency, it is difficult to regulate and, more importantly, to tax.

“[Crypto-savvy retailers] will accept cryptocurrency payments and be exposed to either capital-gains risk or the risk that these currencies will lose their value suddenly and without warning when tax payments and rent are due,” says Khurshid Khoja. The unpredictable nature of crypto makes it impossible to rely on 100%. This means that businesses still must depend on banks for operations such as payroll, taxes, and other expenses like utilities.

Anyone can use cryptocurrency to purchase goods and services. But because it lacks the qualities of traditional currency, it isn’t considered a legal tender. Therefore, although it may be a convenient form of exchange for consumers, merchants run into complications when accepting it. Add this to the number of complications cannabis businesses that want to accept crypto payments already face.

SAFE Banking Act

The Secure and Fair Enforcement (SAFE) Banking Act is intended to give companies access to banking services that are currently unavailable. The SAFE Act would eliminate penalties for financial institutions that provide services to cannabis businesses. Therefore, it would prevent cannabis businesses from experiencing unexpected account closures.

It has passed multiple times in the House but has yet to be approved by the Senate. Without it, the cannabis industry lacks access to loans, capital, and basic bank accounts.

The SAFE Banking Act would also allow dispensaries to minimize the amount of cash they store on-site. This would in turn minimize the amount of robberies they experience. This contributes to the overall safety of dispensary workers and the surrounding communities.

Cannabis Crypto: A Possible Solution

The Problem

Cannabis locations are already prime locations for ATM placement due to their reliance on cash transactions. Additionally, because of the nature of the business, cannabis dispensaries are not authorized to own or operate ATM machines.

They’ve even run into problems with cashless ATM machines. Visa prohibits their use because oftentimes point-of-sale (POS) purchases get miscoded as ATM cash disbursements but do not actually disburse cash which affects the interchange.

So dispensaries cannot accept debit or credit transactions, and cash transactions are a liability. But what about crypto payments? According to Cheyenne Ligon and Sage D. Young, crypto isn’t a fool proof solution, but it’s a start.

Benefits for Dispensaries

First of all, the blockchain associated with cryptocurrency allows dispensaries to process payments affordably and prevents them having to go through third-party processors. Furthermore, crypto wallets offer a level of security not provided by the traditional banking system.

While the federal government is concerned about the use of crypto in illegal activities such as money laundering and tax evasion, the crypto wallets actually ensure accurate reporting by using the blockchain as an audit trail. It can indicate how businesses receive payment and from which wallets.

Cannabis crypto also benefits customers by offering them a safe and convenient alternative to cash or card payments. “Crypto transactions make paying for cannabis goods and services more accessible, as anyone with a smartphone can make a low-cost transaction,” says Casia Lanier.

Although the number of crypto users is relatively low, it is increasing steadily. The more businesses that accept and promote crypto payments, the more public perception crypto will receive, and the more widely accepted it will become.

For those in the business of cannabis, crypto-to-cash payment platforms have encouraged the crypto-curious to take the leap. Benefits include less volatility and guaranteed compliance.

More and more dispensaries will be moving to cannabis crypto payments, if for no other reason, for an alternative to traditional banking services that aren’t available for them today.

The rise of instant crypto-to-cash payment platforms has helped some crypto-curious cannabis companies feel more comfortable about accepting crypto payments, both in terms of avoiding volatility and ensuring compliance with regulations.

According to Lanier, “the potential for crypto transactions becoming accepted forms of payment is high, and the barriers to entry are almost non-existent for businesses across every industry…For businesses thinking of integrating crypto payment solutions, there is no better time to do it than now.”

Cannabis Crypto an Alternative Business Model for IADs

This is good news for IADs. Cannabis crypto provides ATM owners with a new and relatively untapped market for machine placements and uses.

Bitcoin ATM machines (BTMs) function very much in the same way as regular ATM machines. This makes them approachable and user-friendly for business owners, consumers, and IADs.

By offering BTM services to cannabis businesses, IADs can bring cannabis, crypto, and ATM industries together to bypass traditional federal banking regulations that so often shut these businesses out.

Want to convert your ATM machine into a BTM? Interested in getting into the cryptocurrency game? Contact us today to discuss your options!