ATM Operating Rules and Regulations

ATM Operating Rules and Regulations

As with most transactions dealing with banking, there are rules and regulations that must be followed. Operating an ATM (automated teller machine) is no different. If the machine is located on a bank’s premises or operated by the bank at different locations, both state and federal rules and regulations will apply. For privately owned ATMs, there are still regulations, but they vary from those of banks.

ATM Operating Rules and Regulations for a Bank Operated ATMs?

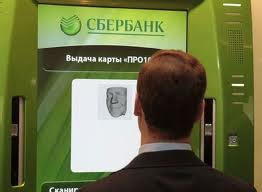

- Video Surveillance: Banks using an analog video surveillance system must follow federal law requirements. The systems must use videotape that is of commercial or industrial grade. It is recommended that the tape only be used one time from beginning to end and within a 30-day period. Once the tape is full, the bank must retain the video surveillance for a period of at least 45 days. After this time, the tapes can be recorded over, but should not be used more than 12 times. Many ATMs are now sold with a built in surveillance system, most of which are digital recording systems.

- Safety Regulations: U.S. Federal Laws are in place for banks operating an ATM, mainly the Federal Electronic Funds Transfer Act and the Bank Protection Act. These laws are in place for security purposes; however, the laws address the security of the ATM itself, not the safety of the user. Although they must still abide by the U.S. Federal Laws, many states have but their own regulations into place for the safety of their customers. States such as, California, Florida, and New York, to name just a few; have passed laws of security standards for ATM operators. Standards have been set for lighting, visibility, security, and landscaping at ATM locations.

- Fees: According to the Electronic Fund Transfer Act (Regulation E), the owner of an ATM was required to both post a physical notification and an on-screen notification that a fee is charged for providing the service of its machine. The physical notice was to be posted on the machine or somewhere visible to a user at the machine. This was most commonly in the form of a sticker on the ATM. On December 20, 2012, the December 2012 Statutory Amendment was approved, which only requires the on-screen disclosure now. Most ATMs still post the physical notice, but are no longer required to do so. Unlike the posted notification, an on-screen notification of fees must include the dollar amount of the charge. This notification offers the user to accept and continue the transaction or to deny the fee and end the transaction.

These are just some of the simple, most common regulations in place for bank owned ATMs. For more detailed information on these and other laws, you can research the Electronic Fund Transfer Act (EFTA), the Federal Electronic Funds Transfer Act and the Bank Protection Act, and U.S. Federal Laws regarding ATMs.

ATM Operating Rules and Regulations for Non-Bank Owned ATMs?

Non-bank owned ATMs have a different set of ATM operating rules and regulations to follow; and are a lot simpler.

- These machines are only allowed to dispense cash; no deposits are accepted at these locations.

- They must display, on the ATM, the logos of the types of cards that are accepted at their machine.

- The owners of the ATM can charge customers a fee for their transaction; however it must clearly be posted at the machine as well as on-screen during the withdrawal transaction.

- All non-bank owned machine owners are required to file an annual notice of ownership which is typically done through the ATM processor they signed up with.

- Some States have their own set of non-bank regulations, check with your ATM Company to be sure they manage this process for you.