Do Businesses Have to Accept Cash? The Payment Choice Act and Other Arguments in Favor of Cash

Do businesses have to accept cash? Yes and no. While there is no federal law prohibiting businesses from going cashless, state mandates might. So, it depends on where you do business and what the situation is.

More and more businesses have been encouraging cashless payments since the onset of Covid-19 for health and safety reasons, speedier transaction times during the labor shortage, and combating the national coin shortage. However, the Payment Choice Act addresses the downside of businesses going cashless.

Although digital payments have their benefits, cash is still not going away any time soon. Businesses and consumers alike still have a number of reasons to prefer cash payments, or at least to want the option.

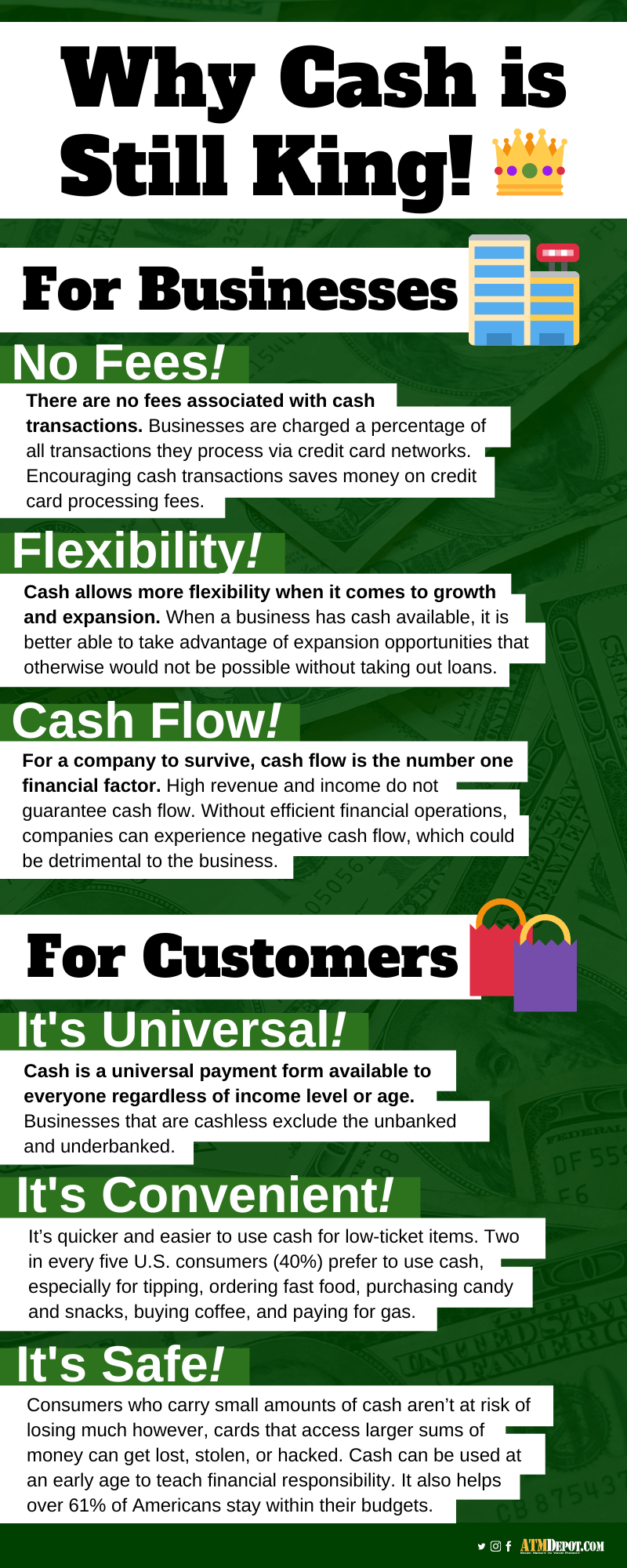

Why Cash is Good for Businesses

While it’s true that contactless and digital payments simplify the transaction process for businesses, there is no need to worry that they will take the place of cash exclusively. Not all businesses will transition to cashless. This is because cash still offers a number of benefits.

No Fees

First of all, there are no fees associated with cash transactions. Businesses are charged a percentage of all transactions they process via credit card networks. So you will frequently see businesses that are cash-only or that have an ATM on-site or nearby. These businesses want to encourage cash transactions because they save money on credit card processing fees that way. Not to mention the money they make from ATM surcharges.

Additionally, the more cash transactions businesses conduct, the fewer chargebacks they’ll have to deal with. Businesses face chargeback fees when consumers file a claim with their banks or credit card companies for services and products they purchase with their cards. In some cases, these transactions get reversed and those businesses lose the value of those sales and incur fees.

Cash allows businesses to pay their bills faster, especially small businesses. Cash payments are immediate. Long processing times associated with other payment forms could cause avoidable late fees.

Flexibility

Secondly, cash allows more flexibility when it comes to growth and expansion. If a company wants to acquire another, it might not be able to without the necessary cash. Furthermore, if a business has cash available, it is better able to take advantage of expansion opportunities that otherwise would not be possible without taking out loans.

Emergencies

Cash is also important for emergency situations and unexpected expenses that aren’t already accounted for in a company’s budget. One of these emergency situations could be an economic downturn. The availability of cash improves a business’s flexibility and therefore its ability to survive.

Cash Flow

Finally, businesses need cash flow. For a company to survive, cash flow is the number one financial factor. High revenue and income do not guarantee cash flow. Without efficient financial operations, companies can experience negative cash flow.

Why Cash is Good for Consumers

Not only do consumers benefit from cash, but for some Americans, that is the only payment option available to them. Cash is universal. It is steady, stable, and secure. Fortunately, it’s here to stay.

Eighty-eight percent of consumers use cash at least sometimes. “There is this surprising resiliency of cash. It keeps hanging around,” says Shelle Santana, assistant professor at Harvard Business School. While contactless and electronic payment methods have their place, they can’t compete with the benefits of cash.

Universal

Cash is a universal payment form available to everyone regardless of income level or age. About 6% of Americans are unbanked and another 16% are underbanked. Ten percent of consumers reported using cash for all of their purchases. Businesses that are cashless exclude these populations. This is a concern the Payment Choice Act aims to solve.

Convenient

Cash is convenient (especially when electronic processing systems fail). It’s quicker and easier to use cash for low-ticket items. Some businesses impose credit card minimums and/or pass their credit card processing fees onto their customers. This makes paying with cash cheaper as well.

According to a survey by a division of WSFS Bank, 39% of U.S. businesses have a cash-only policy for purchases under $20. Two in every five U.S. consumers (40%) prefer to use cash especially for tipping, ordering fast food, purchasing candy and snacks, buying coffee, and paying for gas.

Cash allows people to exchange funds immediately. People can pay friends and family for favors and services using cash without having to wait for processing times or transfer issues. According to the 2018 Health of Cash Study sponsored by Cardtronics, 70% of people surveyed prefer using cash to pay money owed to family and friends while 65% prefer receiving cash when owed money.

Cash is also often used as monetary gifts for birthdays, special occasions, and especially children too young for bank accounts.

Safe

Cash is safe. Consumers who carry small amounts of cash aren’t at risk of losing much. Cards that access larger sums of money can get lost, stolen, or hacked.

Cash can be used at an early age to teach financial responsibility. It also helps over 61% of Americans stay within their budgets. Like businesses, consumers experience emergencies and unplanned events. Having a cash savings can be a lifesaver for those situations that are difficult to predict and budget for.

The Power of Choice

Obviously, card transactions, bank transfers, and other money transfer services take time to process and are often accompanied by fees. Debit card transactions can overdraw a bank account, credit cards charge interest and rack up debt, and both banks and credit card companies have their lists of various annual, setup, and/or service fees. This is part of the reason why a percentage of the population literally cannot afford to have a debit or credit card.

But what’s more important than the value of each individual payment method is the freedom of choice. About 92% of consumers like having a variety of payment methods. More than 90% of households reported using more than one payment method, and the average consumer uses 3.6 payment methods each month.

The Payment Choice Act

The goal of the Payment Choice Act is to provide equality among Americans, allowing everyone to purchase goods and services without discrimination.

The bill stipulates that businesses not eliminate cash as a payment option. The bill would require that businesses accept cash payments for goods and services. The proposed bill prohibits businesses from posting signs that state that they don’t accept cash and from charging cash-paying customers more.

Do Businesses Have to Accept Cash in Your Opinion?

In your opinion, do businesses have to accept cash? There is debate between the right of businesses to choose what payment methods to accept and the right of consumers to choose the payment method that best suits them.

No matter which side you take, cash is here to stay. And so are ATMs. Although ATM withdrawals are declining in number, they are increasing in value. So the need for cash hasn’t changed; the demand is the same regardless. What has changed is consumers’ willingness to travel to an ATM. If you are in the ATM business or are interested in getting started, this is good news. This means that with more ATMs placed around the country, accessing cash becomes less of a hassle. And for a majority of the population, cash is still very relevant.