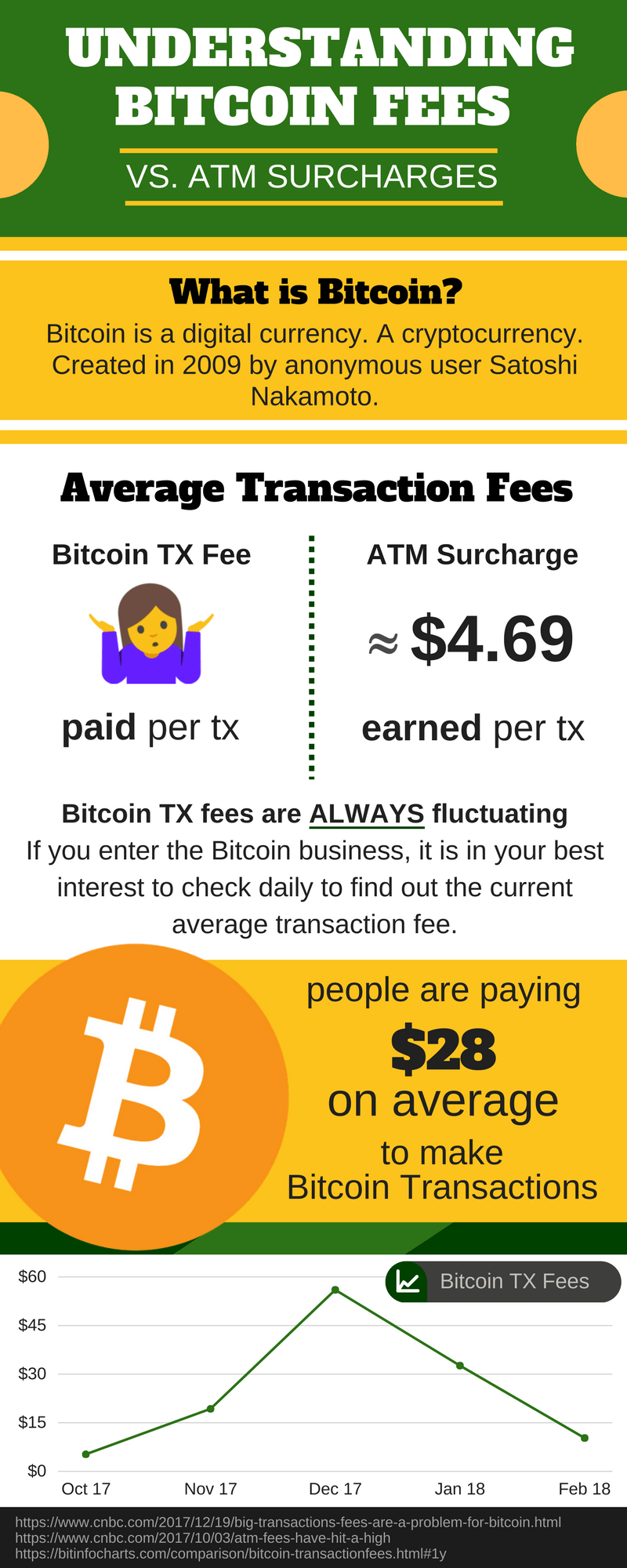

[Infographic] Bitcoin Business vs. ATM Business: Fees Explained Simply

Bitcoin. Who hasn’t heard of it? News of this new form of digital currency is sweeping the nation. Every day it seems we hear of someone else making lots of money from blockchain in the Bitcoin Business. Needless to say, it keeps us interested. But, there’s been a pretty big downfall to investing in the currency lately. Transaction fees are becoming quite a problem. In December 2017, a man moving $25 of Bitcoin paid a $16 fee to do so. According to CNBC, people are paying $28 on average to make Bitcoin transactions. The average transaction fee at an ATM machine is currently around $4. Both fees have been increasing, but Bitcoin’s transaction fee is doing so at a significantly higher rate.

What is Bitcoin?

In its simplest terms, Bitcoin is a digital currency. A cryptocurrency. Created in 2009 by anonymous user Satoshi Nakamoto, the goal was to create a decentralized electronic cash system. Decentralization is one of Bitcoin’s most important characteristics. This means that no single institution controls the bitcoin network. This puts people that don’t like institutions to have control of their money at ease. Another defining difference between common currencies and Bitcoin is pseudonymity. The system does not need to know the identity of any parties involved when Bitcoin is transacted. This anonymity attracts illegal activity which takes up almost half of Bitcoin transactions at the moment.

Source: http://mompreneurasia.com/wp-content/uploads/2017/06/btc-1024×690.jpg

Transaction Fees in the Bitcoin Business

With so many success stories in the media, people are rushing to enter the cryptocurrency business. Transaction fees are usually the first and most visible cost that everyone in the network will experience. With more users joining in, fees are increasing. According to the graph below, transaction fees for Bitcoin in October 2017 total over 22 million dollars. The average transaction fee around that time: around $60.00. The biggest pain point most people in the network have is how much the fees are fluctuating. If you enter the Bitcoin business, it is in your best interest to check www.cryptofees.net daily, or a similar site, to find out the current average transaction fee. The constant variations and shifts keep Bitcoin miners on their toes.

source: https://web.archive.org/web/20181020203539/https://cryptovoices.com/network-transaction-fees/ (2018)

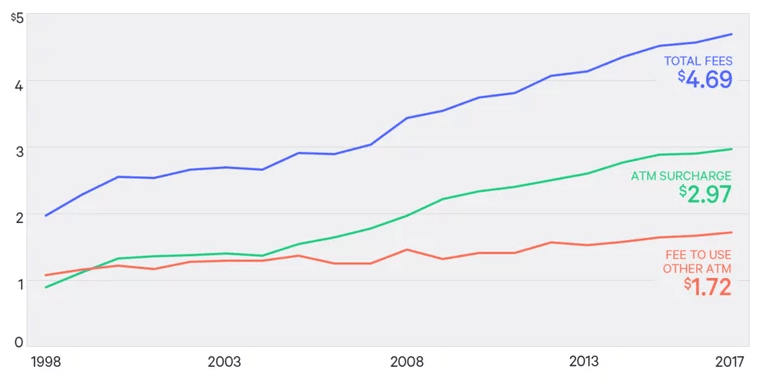

ATM Business Transaction Fees

One of the most common fees we encounter every day has been rising as well. ATM surcharges have reached an all-time high. CNBC reports Pittsburgh has the highest current average at $5.19 while San Francisco has one of the lowest at $3.90. The slowly increasing fee ensures Independent ATM Deployers continue to make a good amount of passive income. As averages continue to rise, remember to update your ATM surcharges to ensure you make more money.

Interested in learning more about the ATM Business? You’re in the right place. Don’t leave this page without getting the information you need. Download our FREE ATM Business Guide by clicking the link below.

source: http://time.com/money/4966816/atm-fees-all-time-high/

TX Fees vs. Surcharge

Although ATM surcharges have been increasing, the fee doesn’t fluctuate as fast as Bitcoin transaction fees. The average annual increase, according to Bankrate 2017, has been 4.7% over the past 19 years. Bitcoin transaction fees are different for each transaction. On this day, the minimum Bitcoin transaction fee charged is recorded at 0.0963%, however, the largest fee recorded is 29.3309%. That’s right. Someone paid $43.00 to send $103.61. Good thing we don’t have to pay a percentage to withdraw money from an ATM.

The average ATM surcharge has been increasing lately, but it’ll be a while before it’s equal to that of Bitcoin. Most people are wondering whether getting into the Bitcoin business would be beneficial. The answer is … probably. If you’re wondering whether getting into the ATM business is profitable, the answer is yes. IADs are racking up on these surcharges that happen to increase each year. You may have to check daily what you’ll pay to transfer Bitcoin, but surcharges don’t usually change on a daily basis. The ATM business is a lot more secure and reliable, however, the Bitcoin business is definitely booming. We’ve created this infographic to help illustrate the difference between bitcoin fees and ATM surcharges.

[Infographic] The Bitcoin Business vs The ATM Business Fees