Voice Activated ATMs and New ADA Requirements

Voice-activated automatic teller machines were designed to help people with visual impairments, including some elderly people, make financial transactions. Not every blind person can read Braille, and so ATM’s equipped with Braille keypads don’t always suffice. In addition, Braille keypads may allow blind people to enter the information they need to, but they don’t provide a means of delivering directions to visually-impaired customers. So unless a blind person were to walk into a bank already knowing exactly how to use the ATM, it might not be possible for him or her to make transactions without assistance from a bank employee. And waiting in line to ask an employee for help can be time-consuming, not to mention embarrassing. Indeed, in the past, some visually-impaired people tended to avoid ATM’s altogether.

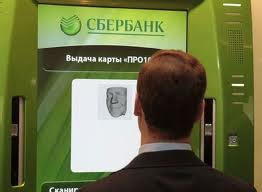

However, a voice-activated ATM solves most, if not all, of those problems. Such a machine works like this:

- A customer plugs his or her headphones into the ATM’s universal audio jack.

- The ATM’s voice activation system is triggered.

- The machine begins to speak to the customer, giving instructions, telling him or her which keys need to be pressed in order to complete a certain transaction.

- The automated voice may also explain how to use the ATM’s Braille keypad, in case that customer does know how to read Braille.

Voice-activated ATM’s are not new. Banks large and small began rolling out this technology early in the first decade of the twenty-first century. For example, all new ATM’s purchased by Australian banks since 2003 have been voice-activated; banks in that nation began installing voice-activated ATM’s as part of a pilot program in 2002. Also in 2002, Banknorth, a small American chain of banks with headquarters in Portland, Maine, began to install voice-activated ATM’s in 400 of its banks, a program that was completed in cooperation with the National Federation of the Blind. In the end, Banknorth – now TDB Banknorth – spent five years and almost five million dollars to get these machines operational.

TDB Banknorth and others may have voluntarily set up voice-activated ATM’s, but today doing so is no longer optional for financial institutions in the United States; it’s mandatory. That’s because, between 2004 and 2010, the U.S. Department of Justice handed down a series of rulings on the issue of voice-activated ATM’s. The result of these decisions was that, as a new stipulation of the Americans with Disabilities Act, or ADA, all banks, credit unions and other financial institutions were required to install at least one voice-activated ATM in every location where they maintained ATM’s. The deadline for these installations was set at April 30, 2012 – the deadline had originally been March 15 of that year, but was extended to give banks enough time to purchase and install these devices. (These rulings came with other requirements for ATM’s as well, including guaranteed wheelchair access.)

It’s interesting to note that the estimated cost of a single voice-activated ATM can vary widely, depending on whether you ask a financial institution or you ask an advocacy group for the visually-impaired, such as the aforementioned National Federation for the Blind. But it’s somewhere between $1,000 and $10,000. Still, whatever the cost may be, most banks found it more economical to purchase entirely new machines rather than update old ATM’s with new software and processing capabilities.

Financial institutions which are not in compliance with the ADA’s voice-activated ATM standards risk lawsuits and other disciplinary measures. Still, in many parts of the country, some banks have yet to fully comply with the new law. In 2012, for instance, a visually-impaired, 30-year-old man name Robert Jahoda filed federal lawsuits against several banks in his home state of Pennsylvania, as well as a bank in Ohio, because they had not yet equipped their facilities with voice-activated ATM’s. Further, a Boston-based consumer protection website called Consumer World conducted a study one month after the voice-activated ATM law’s April 2012 deadline. Consumer World’s researchers traveled around Boston, plugging headphones into random samplings of ATMs all over the city. And the results of this survey were not too impressive: at least a quarter of the automatic teller machines that these researchers tried out did not have a voice activation capacity.

Leave a Reply

Want to join the discussion?Feel free to contribute!